sacramento tax rate calculator

Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. Businesses impacted by the pandemic please visit our COVID-19 page Versión en Español.

Enroll In The Iar Hp Executive Purchase Program During The Month Of August And Be Entered To Win A New Hp Envy Sleekboo Laptop August Month Electronic Products

This is the total of state county and city sales tax rates.

. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. Within Sacramento there are around 48 zip codes with the most populous zip code being 95823. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

Arts and Culture Calendar. Sacramento in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento totaling 075. Sales Tax Calculator Sales Tax Table.

Sacramento is located within Sacramento County California. The minimum combined 2022 sales tax rate for Sacramento California is. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200.

Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. Alameda Alpine Amador Butte Calaveras Colusa Contra Costa Del Norte El Dorado Fresno Glenn Humboldt Imperial Inyo Kern Kings Lake Lassen Los Angeles Madera Marin Mariposa Mendocino Merced Modoc Mono Monterey Napa Nevada Orange Placer Plumas Riverside Sacramento. Sales Tax Data Special Business Permits Starting a Business Taxes and Fees Visitors.

While the income taxes in California are high the property tax rates are. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. To calculate the sales tax amount for all other values use our sales tax calculator above.

After searching and selecting a parcel number click on the Supplemental Tax Estimator tab to see an estimate of your supplemental tax. The current total local sales tax rate in Sacramento NM is 63125. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information.

The County sales tax rate is. For questions about filing extensions tax relief and more call. What is the sales tax rate in Sacramento California.

This calculator can only provide you with a rough estimate of your tax liabilities based on the. 2022 City of Sacramento. The County sales tax rate is.

For questions about filing extensions tax relief and more call. The median property tax on a 32420000 house is 220456 in Sacramento County. The average cumulative sales tax rate in Sacramento California is 841.

A supplemental tax bill is created when a property is reassessed from a change in ownership or new construction. The median property tax on a 32420000 house is 340410 in the United States. This includes the rates on the state county city and special levels.

View the E-Prop-Tax page for more information. Online videos and Live Webinars are available in lieu of in-person classes. The December 2020 total local sales tax rate was also 63125.

The New Mexico sales tax rate is currently. The California sales tax rate is currently. The current total local sales tax rate in Sacramento CA is 8750.

The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate of 068 of property value. Sacramento in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento totaling 075. US Sales Tax Rates NM Rates Sales Tax Calculator Sales Tax Table.

The median property tax on a 32420000 house is 239908 in California. Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and bill the tax. Use the 540 2EZ Tax Tables on the Tax Calculator Tables and Rates page.

Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento County totaling 025. All numbers are rounded in the normal fashion. This calculator does not figure tax for Form 540 2EZ.

The median property tax on a 32420000 house is 340410 in the United States. As far as sales tax goes the zip code with. Sacramento County Sales Tax Rates Calculator Method to calculate Sacramento sales tax in 2021.

The minimum combined 2022 sales tax rate for Sacramento New Mexico is. The Sacramento Sales Tax is collected by the merchant on all qualifying. The December 2020 total local sales tax rate was also 8750.

The Sacramento sales tax rate is. What is the sales tax rate in Sacramento California. Tax Collection and Licensing.

The Sacramento California sales tax is 825 consisting of 600 California state sales tax and 225 Sacramento local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc. California has a 6 statewide sales tax rate but also has 474 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2617 on top. Sales Tax Table For Sacramento County California.

By clicking Accept you agree to the terms of the. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Discover Helpful Information And Resources On Taxes From AARP.

You can find more tax rates and allowances for Sacramento and California in the 2022 California Tax Tables. All are public governing bodies managed by elected or appointed officers. Sacramento Sales Tax Rates for 2022.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 819 in Sacramento County California. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The Sacramento sales tax rate is.

This is the total of state county and city sales tax rates. AZ CA HI NV OH OR WA. Did South Dakota v.

The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a. Californias notoriously high top marginal tax rate of 133 which is the highest in the country only applies to income above 1 million for single filers and 2 million for joint filers. Sacramento County collects relatively high property taxes and is ranked in the top half of all counties in the United States by.

How School Boundaries Impact Real Estate Values Real Estate Values Real Estate Home Appraisal

Tax Rates Stripe Documentation

Tax Implications For Canadians Selling Us Property Real Estate Madan Ca

California Vehicle Sales Tax Fees Calculator

The Social Benefits Of Home Ownership Home Ownership Real Estate Home Buying

How To Calculate Cannabis Taxes At Your Dispensary

The Health Crisis Slowed The Market This Spring So Buyers Are Jumping Back Into The Market To Make Their Moves This Real Estate Things To Sell Home Ownership

Fha Loan Limit Calculator Fha Mortgage Limits Freeandclear Mortgage Refinance Calculator Mortgage Amortization Calculator Refinance Calculator

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Taxi Fare Calculator Sacramento California Taxi Sacramento Airport Sacramento

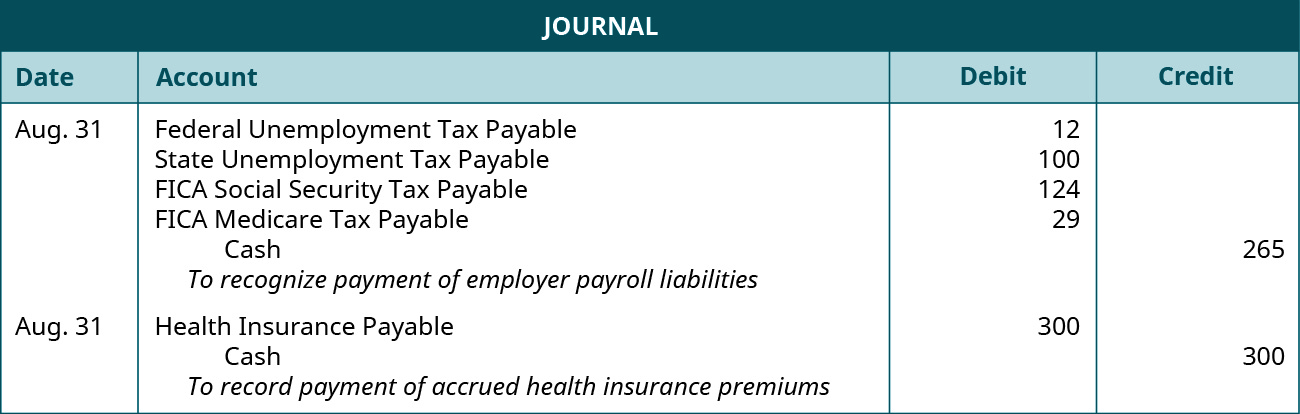

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Secured Property Taxes Treasurer Tax Collector

Hate High Income Tax This Will Provide You Big Relief

Profiting From Understanding The Real Estate Cycle First Time Home Buyers Home Buying Real Estate

Sacramento California Local Barber Shop Photo Photography Portfolio Photography Branding Branding Photos